This is a vital step where AP manager have to be positive that buy invoice or bill has all of the relevant data corresponding to vendor name, item particulars, payment particulars, etc. In each company, the accounts payable process is dependent on the organization’s size and hierarchy. In small corporations, the whole course of is done by the accounts payable supervisor. Nonetheless, in massive organizations, every step will be executed by completely different accounts payable executives. If you had to do that manually each time you needed to see your AP getting older report, you’d wind up losing lots of time. Small, medium, and huge businesses alike will want to rely on their financial software to generate an AP getting older report instantly and without errors.

Bar Cpa Practice Questions: Proprietary Funds Assertion Of Money Flows

Just upload your type sixteen, claim your deductions and get your acknowledgment number on-line. You can efile revenue tax return in your revenue from wage, home property, capital features, enterprise & occupation and income from other sources. Additional you can also file TDS returns, generate Form-16, use our Tax Calculator software program, claim HRA, check refund standing and generate lease receipts for Income Tax Submitting. All testimonials, evaluations, opinions, or case studies introduced on the website may not be representative of all clients. You can go one step further if you use AP automation software like ApprovalMax. This allows them to keep away from disruptions within the provide chain and construct trust with their enterprise partners.

This proactive approach helps you tackle potential cash move points before they impression your business. Think About having the foresight to anticipate problematic invoices and take preemptive action. This permits for simpler communication with customers and reduces the risk of late funds. Beyond individual customer habits, aging schedules supply a broader view of your organization’s financial well being. They can reveal if a few giant, overdue accounts are disproportionately impacting your common collection time, also called Days Sales Outstanding (DSO).

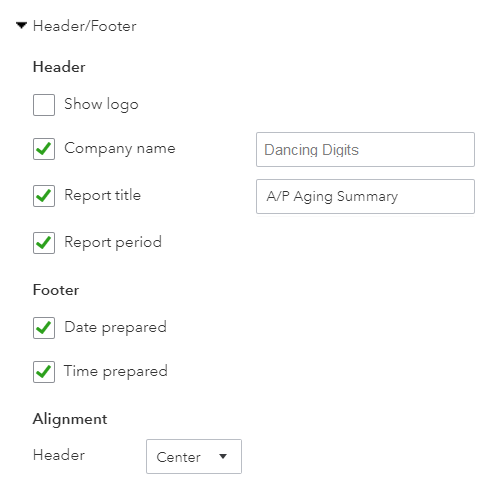

Due To This Fact, there is a delicate balance to be struck in managing AP that satisfies each parties. Accounting software program and ERP methods provide the functionality to routinely generate accounts payable growing older reviews each month as a Element report and Summary report. Most AP getting older stories don’t embrace the vendor’s terms as a outcome of they assume payments are due inside 30 days. If you employ accounting software, the software mechanically removes the stability from the accounts payable getting older report if you report the fee in your books. As A Substitute of showing what you owe others, an accounts receivable growing older report exhibits the balances of how a lot others owe your business.

What Is Accounts Payable Automation?

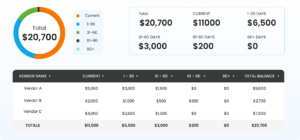

While you possibly can track Accounts Payable Getting Older manually, it’s not beneficial as a outcome of potential for errors and inefficiency. It categorizes debts into time frames like 0-30 days, days, and so forth, giving you a snapshot of what’s due now and what’s coming up. Implementing and maintaining an growing older schedule isn’t with out its hurdles. The other columns are invoices which are over 30 days old and are usually overdue. For example, if a balance is beneath the 1 – 30 days column, it’s 1 – 30 days late.

Utilizing your growing older schedule proactively may help you preserve a healthy monetary place and make data-driven choices that assist long-term growth. Consider scheduling a data consultation to discuss how HubiFi can automate this course of for you. An aging schedule is a financial report that categorizes a company’s accounts receivable or accounts payable based on the length of time they have been outstanding.

- Your accounts payable consists of debts from buying issues like stock, supplies, and services to function your corporation.

- Widespread categories embody current (not but due), 1-30 days overdue, days overdue, days overdue, and over ninety days overdue.

- Regularly updating your AP growing older report and automating the method lets your staff proactively handle payments, avoid late fees, and optimize cash circulate.

- When any goods or providers are bought on credit score out of your vendor or supplier, they’ll send you an invoice.

- In easy terms, an accounts payable (AP) aging report is a record of the outstanding invoices your corporation owes its suppliers or distributors for a selected accounting interval.

With modern accounting systems, you’ll have the ability to run an accounts payable report daily or anytime on demand to handle your company’s accounts payable and required funds. An AP Aging Report is organized into several key components, every serving a specific purpose in financial analysis. Every row is dedicated to a vendor or supplier and exhibits the past-due invoices that the business owes. Auditors use the AP Aging Report during financial audits to verify the accuracy of the accounts payable steadiness.

Nevertheless, if each AR and AP present significant growing older, it could presumably be a pink flag for underlying operational or monetary inefficiencies. The accounts payable ageing report should typically be run and examined each month. This will allow you to determine whether you are using credit responsibly or relying too much on it. When you purchase items or providers on credit score, you may wind up owing a vendor for several transactions.

Whether you are a small enterprise owner or a financial professional, understanding and utilizing an ageing schedule is crucial for effective monetary management. In this post, we’ll discover the ins and outs of ageing schedules, from their fundamental definition to superior management techniques. We’ll additionally discuss the key benefits of utilizing an ageing schedule, including improved collections, enhanced buyer relationships, and more accurate financial forecasting.

Understanding your DSO and the proportion of present versus overdue receivables offers essential insights into your general monetary standing. Frequently reviewing your growing older schedule lets you identify trends, address potential issues, and implement methods to enhance your monetary place. Extending credit score to clients is a typical business practice, nevertheless it additionally carries inherent dangers. By figuring out clients who constantly pay late, you’ll find a way to refine your credit policies and decrease potential losses from late or non-payments. This evaluation helps you make knowledgeable choices about offering credit score terms and set acceptable credit limits. Analyzing buyer cost patterns is a key facet of managing credit threat.

Accounts payable automation will allow you to to reduce the time and price of purchase bill processing. AP automation will also help to scale back human errors and enhance effectivity. All firms should implement AP automation software to streamline the accounts payable process. Implementing accounts payable automation software will get rid of a lot of the paperwork concerned in bookkeeping. The AP division is responsible for making and monitoring of all the seller https://www.simple-accounting.org/ funds.